The secure, view only, bank account service to help manage the finances of others when they can’t do it alone.

The secure, view only, bank account service to help manage the finances of others when they can’t do it alone.

Log In

Register

Guides

FAQs

How we can help you

Our mission is to enhance the financial security and independence of those with additional needs or victims of fraud by linking them to a Trusted Person who can provide support.

With our app, a bank Account Holder links to a Trusted Person, like a carer or family member, who can provide financial support. Once linked and with consent, we provide a view only bank service to the Trusted Person who can check the Account Holder’s recent bank account transactions – without the need or ability to login to the Account Holder’s bank account. The Account Holder and Trusted Person can remove links to each other at any time to stop use of the service. We are trusted by leading UK banks, such as the Lloyds Banking Group, and regulated by the FCA, to provide a secure and reliable service.

Keep teenagers in credit

Someone special to you

Your connected community

It’s better together

Giving back to parents

It takes just minutes to set up

To register you will need an email address and a UK mobile phone number.

Register

Both the Account Holder and Trusted Person will need to register.

Invite

Once registered, the Account Holder can log in to Family Connect, link to their bank account(s) and send an invitation to their Trusted Person by using a QR code or sending an email.

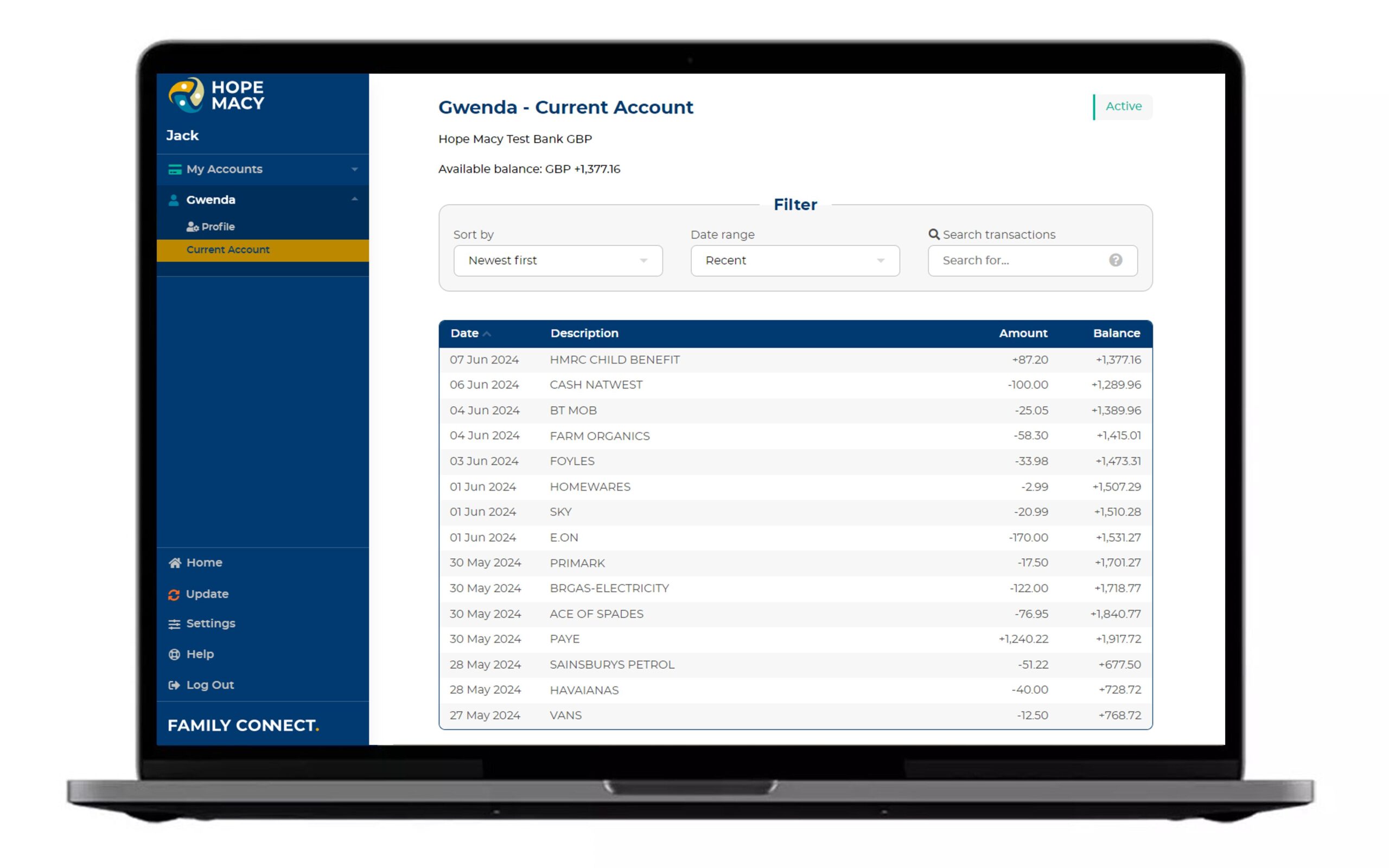

View

Once the Trusted Person has accepted the invite, they then have view only access to the Account Holder’s bank transactions.

Ease of Registration

Registration is free, quick, and straightforward. There’s no requirement for Account Holders or Trusted People to contact their bank, change bank accounts, or establish power of attorney.

View Transactions

Trusted People can view the Account Holder’s bank transactions using our service, ensuring transparency without requiring direct access to a bank account.

Automatic Updates

We send Trusted People automatic email updates about the Account Holder’s bank transactions, enabling prompt attention to any concerns such as scams or unusual spending.

Educational

The Trusted Person can use the service to help an Account Holder bank safer, and maybe transition to a standard banking app.

Independence and Security

Account Holders maintain their financial independence by avoiding the need to share sensitive bank login details. Trusted People can view transactions to safeguard against scams, ensure bills are paid, and verify income received.

Limited Access

Trusted People cannot use our service to make payments, withdraw funds, or apply for credit on behalf of the Account Holder, ensuring their financial security.

Why Join?

It gives you freedom to be out and about, knowing you’ll be notified about any family spending. We tell you all you need to spot missed or unexplained payments. You can even watch out for spending related to social issues such as gambling.

As well as being easy to join, it’s easy to leave. You and any family member can simply stop sharing information at any time. No contract, long-term commitments or hassle.

Save Time

Save Worry

Achieve Goals

Less Effort

Family members don’t give you their bank account security details, they just give permission for you to see their transactions. You both simply register with Family Connect, and then they send you an invitation to view their bank transactions. They will need to renew consent every three months, but then there’s nothing more they need to do.

Less Cost

There’s a small monthly fee the Account Holder pays to receive support from family members, and it doesn’t cost you a penny. Considering the cost of unexpected overdrafts, ongoing scams and overspending, Family Connect could end up saving you money, as well as stress.

A message from the CEO

“As a parent of a teenager with additional needs, I was worried about how he would manage his money. I looked around for a banking service to help him and found nothing that was suitable. Having worked all my life with technology in the banking sector I knew I could create something that could help my family and my friends. A service that’s valuable, simple and transparent. So we created Family Connect to provide the support that I believe people need.

There are many people who may need help with their finances – older parents or children living away from home for the first time. They need their independence but may want support and reassurance too. Our service allows Trusted People to have oversight of all spending and saving, so they can step in quickly if problems occur.

Why not give Family Connect a try and see if it helps you too? Register now – it’s quick and easy.”

Sam Manning

CEO